Most of us can relate to walking up to our attic to find an important document, special treasure, or piece of clothing that came to our mind because of a life event or changing season. So much stuff has accumulated over the years to the point where it seems impossible to find what you are looking for. Furniture, clothes, toys, and holiday decorations are scattered all over the place. You know that frustrating feeling! After spending a few hours searching, you exhaust your efforts. The clutter is just too overwhelming.

The same type of frustration can occur when trying to put together all your important financial pieces. Investment and bank accounts statements, insurance policies, tax returns, wills and trust documents are a lot to keep up with. You probably have 10 different logins with passwords to keep up with to check your accounts periodically.

If we had to summarize the three main things we do for our clients, it would be to help:

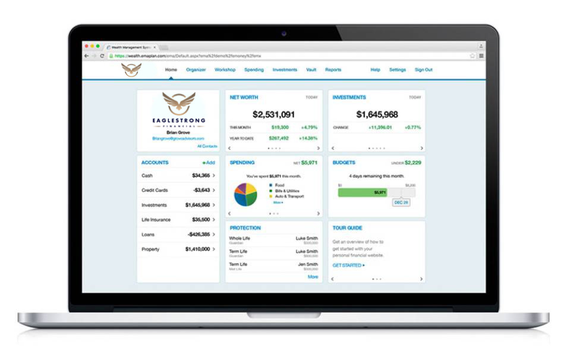

This is the first of a 3-part series covering these topics in more detail. There are many ways that we help you organize your finances. One of the main ways is setting you up with a personal financial website where we help you link all of your accounts in one place. This helps you see your overall financial picture in one snapshot.

The website includes a vault where important insurance and legal documents can be stored. The vault also stores monthly/quarterly investment statements of accounts that we manage. While we don’t think it’s necessary for you to look at your investments every day, it is reassuring to know these statements are stored in the vault whenever you do need to access them. Some clients have us store their yearly tax returns in the vault as well.

The convenience of being able to go to your financial website to get important information when you need it brings peace of mind and helps you not feel like everything is scattered in many different places. Sometimes when making a big financial decision, you can feel overwhelmed. However, when you have your full financial picture in front of you, it is easier for us to help you make smart, proactive decisions.

For those who prioritize budgeting, the website allows you to easily set a budget, categorize expenses and track your progress. If you like to be able to interact with your financial plan, we can link it to your financial website as well.

You can access your personalized financial website from your computer or from any of your smart devices. Advanced security features include password protection, Secure Socket Layer encryption, firewalls, intrusion detection, audits and inspections. You can be confident that your important information is safe and secure.

So we won’t come organize your attic but we would love to give you peace of mind that your finances are organized.

This is the first of a 3-part series covering these topics in more detail.

Read part 2 here: Reducing taxes (whenever possible)

Read part 3 here: Investing wisely

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP® 901.413.8659 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, save taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: