If we had to summarize the three main things we do for our clients, it would be to help:

This is the second of a 3-part series covering these topics in more detail.

Read part 1 here: Organizing your finances

Read part 3 here: Investing wisely

Investments, income, and savings are all associated with how much tax you owe from year to year. Whether it is the type of investment, certain account that you place your savings in or how much you contribute, the complexities surrounding where to put your money and when can have a material financial impact. While sometimes the amounts you can contribute to an IRA or Roth IRA are small in one year, the tax savings or advantages can add up over time.

Doty and I are both CPAs. We do not prepare tax returns but work closely with CPAs and tax preparers to ensure we are mindful of all tax-efficient opportunities for each individual or family situation. Perhaps the best way to show you the value of coordinated financial planning surrounding taxes is to share a case study of a family’s savings associated with retirement, education, health, and charitable giving.

Case Study – Profile

Joe and Mary are 49 years old and have two children. Mary is a dentist and owns a practice with four employees. Joe is a distributor for various medical devices. He is an independent contractor with no employees.

Retirement Savings

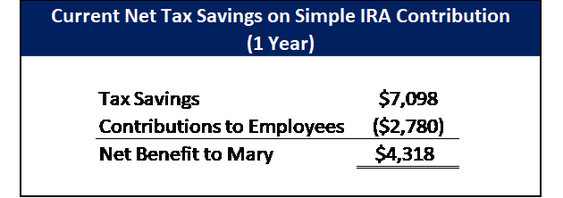

Mary earns $250,000 from her practice each year after business expenses. This year she contributed the maximum $17,500 to her Simple IRA. In order to make this maximum contribution for herself, Mary contributed 2% of pay or $2,780 for her employees into their Simple IRAs. At a 35% tax rate, Mary will save $7,098 in current taxes. The contributions to employees offset some of Mary’s current tax savings but she has very little turnover as her employees appreciate the contributions that she makes for them. Mary is aware that a 401(k), profit-sharing, and/or pension plan would help her save even more for retirement. She plans to pursue these options after her kids graduate from college because she will have more cash flow at that time. The pension plan would allow her to increase her total annual retirement plan savings to $100,000+ which would also generate more current tax savings.

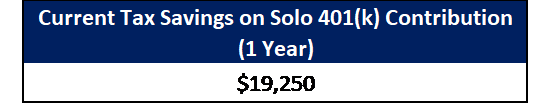

Joe earns between $100,000 and $250,000 annually after business expenses. His income fluctuates from year to year based on the sales and demand for certain medical devices. Because he is an independent contractor and has no employees, Joe contributes to a Solo 401(k) each year. Joe likes the Solo 401(k) because of its flexibility with his fluctuating income. When his net income for the year is lower at $100,000, he contributes approximately $35,000. When he has a great year of $250,000 net income, he contributes the maximum $55,000. This year Joe’s net business income was $250,000 which allowed him to contribute the maximum $55,000. At a 35% tax rate, Joe would save $19,250 in current taxes. Joe was utilizing a SEP IRA a few years ago but his advisor pointed out to him that while the maximum contribution is the same as the Solo 401(k), Joe could contribute a lot more to the Solo 401(k) in lower income years because he gets to make employee and employer contributions. (more details on SEP IRA vs. Solo 401k)

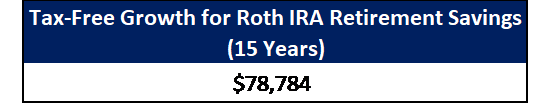

Joe also contributes $5,500 to an IRA each year. Because of his and Mary’s combined income and participation in the Simple IRA and Solo 401(k), they do not receive a tax deduction for his IRA contribution. Joe does not have any other IRA balances so his contributions are converted to a Roth IRA each year with no tax effect. Assuming an 8% annual investment return over 15 years, Joe would have $161,284 in his Roth IRA of which $82,500 would be his contributions and $78,784 would be tax-free growth. Joe will be able to withdraw money in retirement from this account tax-free under current law.

Education Savings

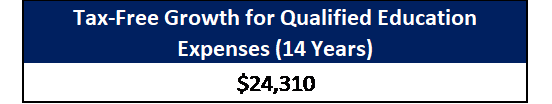

Joe & Mary began contributing $200 per month to a 529 Savings Plan for each child when they were 5 years old. Their oldest daughter is 18. Her 529 plan account has grown to $57,910. Joe & Mary contributed $33,600 total over the last 14 years and the remaining $24,310 of the balance is tax-free growth for qualified education expenses. The investments have grown 7% annually. Their son is 16 and will be in a similar situation when he turns 18.

Health

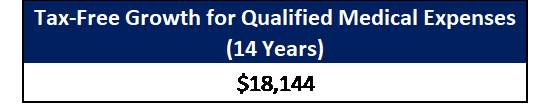

When Joe and Mary were 35, their advisor told them about a High Deductible Health Plan combined with a Health Savings Account (HSA). Their family was healthy and they had emergency cash to pay for health expenses if a family member got really sick and they had to pay the total deductible and out of pocket maximum. For the last 14 years, they have been contributing the family maximum to their HSA. While they use their HSA for some medical expenses throughout the year, they have had net additions to their HSA of $3,000 per year. After contributing to an HSA for 3 years, they began to invest the money in their account. The investments have grown by 5% annually. Today, Joe and Mary have a balance of $60,144 in their HSA account. Their net additions have been $42,000 over the years. Their advisor helped them understand early on the triple tax advantage of health savings accounts. (more details on an HSA)

Charitable

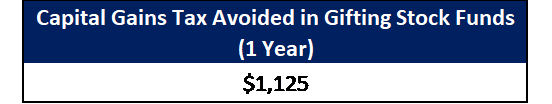

Joe and Mary have also built up $100,000 in a Joint Taxable investment account. They setup automatic monthly deposits of $50 per month when they married and increased that amount over time. Also, when Joe has really good years in sales, they will save $20,000 into the account. Every now and then, they take some money out of this account to fund vacations. Because the account has been around since they married, there are mutual funds with significant gains. Joe and Mary would like to give their church $15,000 this year. Their advisor recommended giving a stock mutual fund that had a 100% gain instead of cash. They will give $15,000 of the appreciated stock fund to the church and deposit $15,000 cash into their joint investment account to invest and replace the gifted stock fund. At a 15% tax rate on the capital gain of $7,500, Joe and Mary will save an additional $1,125 in taxes by gifting the stock fund to church vs. gifting cash.

As you can see, there are many ways to utilize certain accounts to optimize your investments and taxes. While we didn’t cover every possible situation in this case study, everyone has the ability to work with a strategic advisor to make smart tax-efficient moves that can add up to significant savings over time based on your specific situation. Making these wise moves does not just happen; it takes coordinated work between the advisor, individual, CPA or tax preparer, and others to execute. We enjoy initiating and managing these discussions continually to maximize value to those we serve.

This is the second of a 3-part series covering these topics in more detail.

Read part 1 here: Organizing your finances

Read part 3 here: Investing wisely

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize finances, reduce taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: