I recently finished the book The Behavioral Investor by Daniel Crosby – a great read with so many pieces of wisdom. With the volatility in the stock market over the last several months, it is an opportune time for me to share the highlights from the book. Our investment philosophy is to focus on what we can control – diversification, low costs, and tax efficiency. However, all of those important decisions are irrelevant if we cannot manage our emotions during volatile times. Understand, I am in no way minimizing the frustration and anxiety that stock market declines can cause, but rather stressing why our understanding of human nature can help us avoid catastrophic investment mistakes.

Our brains and emotions are geared to respond to events by taking action. This makeup is beneficial to us in fleeing danger or fighting for survival. However, it is a detriment to successful long-term investing where sticking to a plan is of utmost importance.

| “Asking someone built for short-term survival to become a long-term investor is a bit like trying to paint a room with a hammer. You can do it, but it’s not pretty.” |

Most of you have personal experiences with investing. Whether it is participating in the tech bubble in the early 2000s, financial crisis in 2008 or maybe some experience being exhilarated or disappointed in a promising stock with a family member or friend. Whatever the experience, your view of markets is most likely shaped by those experiences. A person that started investing in 1980 would have a much different view of investing compared to a person that started investing in 2000. The key is to understand your experiences and not let them cloud your view but instead become a student of market history. The future will always be different but history gives us a good idea of what to expect.

There are four areas that the author points out affecting our behavior risk – Ego, Conservatism, Attention and Emotion. I’ll give a brief summary on each area.

Ego

Our world today is filled with news stories to grab our attention. We feel we need to stay updated on the latest headlines. However, the author points out what we really crave is “olds” not “news.” We want to validate what we already believe to be true. This is called confirmation bias. It is what helps us maintain our ego. This is why many of us choose to get our news from networks that are more biased towards our political views. In investing, our ego does not like the uncertainty involved. Therefore, people have a tendency to invest in companies they are familiar with even if it's not the best investment strategy.

Solution: Recognize our confirmation bias. Understand that nothing is certain in investing. Diversification allows you to manage risk while achieving return.

Conservatism

At the heart of conservatism is that the fear of loss has more effect than the chance of gain. If pain is expected, it is much easier to tolerate. Because the financial markets subject our investments to ongoing volatility, our thoughts can easily focus on conservatism. Many times, we are faced with so many decisions that conservatism causes paralysis. We avoid making a decision out of fear of regret. No decision at all does allow us to avoid loss or regret in the present, but may bring to pass the very thing we were trying to avoid in the first place. The author recently posted on Twitter that this is his favorite paragraph in the whole book:

| “Think about the most meaningful thing you have ever done. I would wager that it took a measure of risk, uncertainty and hard work to achieve. In this, as with all risk, comes a valuable lesson: to strive for certainty is to doom oneself to mediocrity. Nothing is less safe than playing it safe and nothing guarantees loss like trying to avoid it. Consider the person who remains unattached to avoid risking heartache and finds loneliness in the process. Or the would-be entrepreneur who never makes the leap of faith and wastes a career working at jobs they hate. Or the investor paralyzed by a fear of volatility that arrives at retirement with resources inadequate to meet their needs. Indeed, the irony of obsessive loss aversion is that our worst fears become realized in our attempts to manage them.” |

Solution: Invest with a view of tomorrow over today. Understand that market downturns happen and are a natural part of investing. Accept volatility as a long-term investor in order to achieve returns.

Attention

The power of story has much more impact on our brains than facts. The author uses the example of IPOs (initial public offerings). Everyone wants in on the stock that is going public because they don’t want to miss out on a big gain. An IPO is usually surrounded by lots of media attention. The facts tell us a different story.

| “…the average IPO in the US has gone on to underperform the market benchmark by 21% per year in the first three years following its release.” |

We crave information constantly because technology today allows us to access it. However, we must screen media and news stories as an informed consumer. The author tells a story about appearing on a major financial news network to discuss the markets during a volatile time. He shared some thoughts right before going on air and then the producer spoke into his ear piece.

| “Don’t be a nerd, we’re selling news here.” |

It is up to us to sort out the facts and not get caught up in catchy stories.

Solution: Market prognosticators and complicated stories must be ignored. You must cling to facts and evidence to support new information.

Emotion

Many of our decisions are made based on emotions. A familiar saying is “they will forget what you said but always remember how you made them feel.” The extreme emotions in investing that come to mind are fear and greed. It is clear that money affects our emotions but it also evident that emotions are not healthy for investment decision making.

| “…investors who mire themselves in the day-to-day minutiae of the markets and experience all the accompanying emotions are likely to make a thousand tiny decisions that end in a penniless retirement.” |

Solution: Determine an asset allocation and investment strategy that you can stick with during the ups and downs in the market compared to making changes around volatile disruptions. Having a goals-based investment approach allows us to separate our money into buckets for short, mid, and long-term time horizons with various levels of risk. This approach can really help us compartmentalize risk.

Our best advice is to have a sound investment plan in place while realizing it will take the right mindset and behaviors to stick with that plan through volatile times. If we learn to recognize and manage our thoughts and emotions surrounding investing it will most likely lead to much success. This success is likely to produce not only sound investment returns over the long-term, but also a more satisfying and fulfilling life with proper expectations.

We believe good investing behavior does not come to anyone naturally. It needs to be taught and learned over time and will be a constant battle. As advisors, one of our most important roles is to help our clients understand this side of investing. Our emotions have to be kept in check; otherwise, they cause us to do the exact opposite of what is wise.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp's passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize finances, reduce taxes, and invest wisely. Tripp strives to work in a humble and transparent way.

Tripp has extensive experience in financial planning and investment management, and he diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. When he is not managing his firm and his clients, Tripp enjoys spending time with his family, running, and cheering on the Rebels and the Cubs.

References

The Behavioral Investor by Daniel Crosby

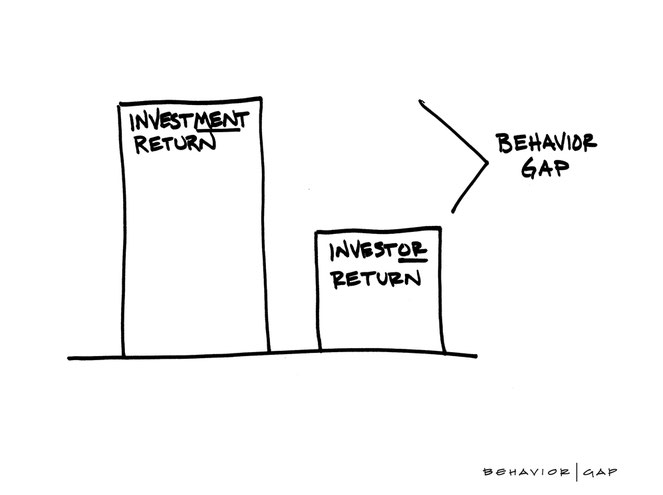

Behavior Gap image: https://behaviorgap.com

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: