You may have heard of the Backdoor Roth IRA. It is a strategy for those whose income is above the limit to contribute to a Roth IRA. However, they can still contribute indirectly by converting a non-deductible IRA contribution. While we encourage this strategy, the maximum amount is limited to $6,000 per year or $7,000 for those age 50 and older. Many people are looking for the ability to save more to a Roth. At the same time, many people enjoy the tax savings in maximizing their traditional 401k contribution.

With the Mega Backdoor Roth IRA, you can do both. If your company retirement plan allows after-tax contributions and in-service withdrawals or rollovers, then you can utilize this strategy.

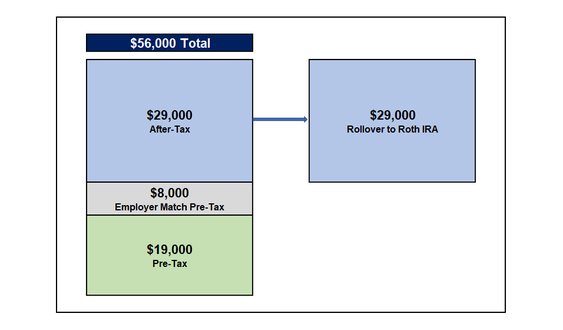

In 2019, you can make 401(k) employee contributions up to the maximum $19,000. Those age 50 and older can contribute an additional $6,000 catch-up. Your company may provide a matching and/or profit-sharing contribution on top of your contributions. The total combined employee and employer contributions are limited to $56,000 or $62,000 for those age 50 or older. Many people are not reaching this combined contribution maximum. That is where the Mega Backdoor Roth IRA strategy comes into play.

To illustrate how this strategy works let’s walk through an example of a 45-year-old with $200,000 annual income.

The maximum 401(k) employee contribution of $19,000 is made to the regular 401(k) along with the employer match of 4% or $8,000. Both of these contributions are pre-tax which means you don’t pay tax on this money until you pull it out in retirement. This still leaves $29,000 available to contribute to the 401(k) plan as after-tax contributions which means you will pay tax on these contributions just as you would other income. However, the after-tax contribution portion can then be rolled over to a Roth IRA tax-free. Some company plans may only allow you to rollover once per quarter or less.

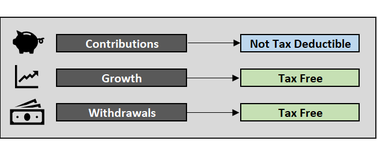

By getting your after-tax contributions to the Roth IRA, it allows the contributions and future growth to be withdrawn tax-free in retirement under current law. If the after-tax contributions are invested in the 401(k) plan, you will owe tax on the investment growth associated when you make withdrawals.

For those who already have after-tax contributions that have been invested in their 401(k), you will be required to roll over the investment growth associated. You can roll that into a traditional IRA to avoid tax on the investment growth. You can always convert the traditional IRA to Roth IRA if you decide you would rather go ahead and pay tax on the investment growth.

We believe now is a good time to get more money into a Roth IRA for several reasons.

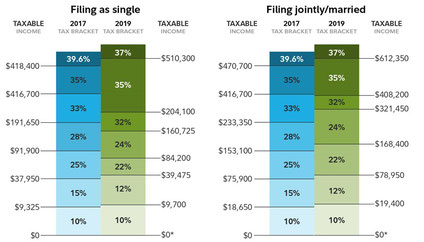

- Current tax rates are historically low and set to expire after 2025. It is likely that tax rates will be higher in the future. You can see the current year 2019 tax rates compared to those under old law in 2017 in the chart below.

- Avoid required minimum distributions starting at age 70 ½. Retirees have most of their money in a traditional 401(k) or IRA. Whether they need the money or not, they will be required to take withdrawals that are taxable each year. Because Roth IRA withdrawals are tax-free, there are no requirements to withdraw the money. This provides more flexibility surrounding your taxable income in retirement.

- Investment growth and your contributions are tax-free when you withdraw in retirement. Under current law, there are no taxes on withdrawals from a Roth IRA after age 59 ½.

Diversifying the tax structures of your retirement accounts will provide more flexibility around your taxable income in retirement. The Mega Backdoor Roth IRA strategy is a way to build up your tax-free Roth IRA account quickly. If this strategy sounds appealing to you, check your retirement plan documents to see if your plan allows it.

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is an active member of Harvest Church.

References

https://www.madfientist.com/after-tax-contributions/

https://www.nerdwallet.com/blog/investing/mega-backdoor-roths-work/

https://rodgers-associates.com/newsletters/retirement-funds-exempt-from-creditors/

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: