The first half of 2024 was marked by a continued advance of the U.S. stock market. The 5% correction in April led many to anticipate a further sell-off that did not materialize. The market rebounded in May and June to produce good returns at the mid-point of the year. The technology sector which now makes up just over 30% of the S&P 500 (U.S. large companies) has led the advancement with breakthroughs in artificial intelligence. Can technology companies maintain their high expectations and growth rates ahead? We believe diversification across stock size, sectors and regions remains prudent. U.S. bond returns have been muted year-to-date as the expectations of interest rate cuts by the Federal Reserve were reduced to 1 in 2024 instead of 3 when the year started. Interest rate expectations are a moving target based on the flow of economic data.

Year-to-date 2024 through June 30th:

S&P 500: 15.3%

Dow Jones Industrial Average: 4.8%

U.S. Small Companies (Russell 2000): 1.7%

International Developed (MSCI EAFE): 5.3%

International Emerging Markets (MSCI EM): 7.5%

Bonds (U.S Aggregate): -0.7%

The Economy

The U.S. Federal Reserve has continued to give the economy medicine with higher interest rates to fight the sickness of high inflation over the last several years. The medicine is working as inflation has slowed but not yet to the level to satisfy the Federal Reserve. Because a lot of the data that the Federal Reserve uses to make decisions is lagging or looking backward, they run the risk of over or under medicating with their action regarding interest rates. Most Americans, me included, are still in sticker shock to the prices of everyday purchases but we are comparing to what we were paying a couple of years ago at this point. The good news is that inflation measured by the consumer price index (CPI) is around 3% year-over-year now vs. 9% in 2022. The Fed’s goal is 2%. While we may see higher than expected increases some months due to various factors, the overall trend is down.

Employment is another major aspect of the economy and the Fed’s mandate. Job openings have contracted while the unemployment rate has not spiked which has been good so far. The unemployment rate remains historically low at 4%. Another positive related to employment is that wages have had 4% year-over-year growth helping consumer spending and offsetting current inflation.

It is clear with the latest Services Purchasing Managers’ Index (PMI) data released in early July that the economy is slowing. Keep in mind that was and is the intent of the Federal Reserve’s higher interest rates in order to tame inflation.

There are still positive signs economically amid slower growth. For example, U.S. rail traffic has now been in expansion for 3 consecutive quarters which is not a sign of recession. Company earnings growth has been the catalyst for the stock market in the first half of the year and expectations are that it will continue and broaden across more sectors in the second half. The Fed’s ability to give the correct dosage of medicine to the economy by deciding when and by how much to lower interest rates will be important in the coming months.

The Election

With the first debate concluded in June and party conventions looming this summer, the presidential election coverage is starting to heat up. Heightened uncertainty of who the democratic nominee will be following the debate has only added to the drama. It’s important for us to be informed and express our right to vote. But, trying to forecast the stock market direction as it relates to who is in power is not a good investing strategy. Remember, we are investing in diversified companies that are focused on growing no matter who is in the White House. They will innovate and adapt to the current circumstances. US presidents can have an impact on stock market returns, but so do many other factors. As you see below, the stock market has moved up and to the right during most presidential terms over the last 97 years.

The Stock Market

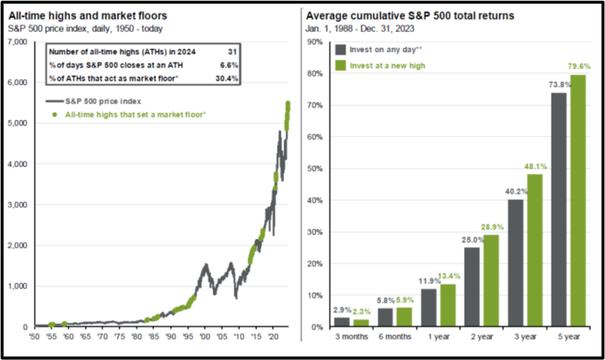

As the stock market advance reaches new all-time highs, expect more calls for a recession and market downturns. Fear has been known to naturally gain our attention more than anything else. Headlines usually focus on what could go wrong instead of what could go right. It’s wise to keep in mind that forecasts are just guesses and that there is usually another side to the story to balance things out. Two years ago, many pointed to the market timing signal of an inverted bond yield curve flashing red and forecasting a recession. Since the inversion, global equities are +37%. Over the last week, JP Morgan market strategist Marko Kolanovic left the bank after getting forecasts of market direction wrong in each of the last 3 years.

While it is logical to expect a market pullback when new milestones are reached, the facts tell us that higher all-time highs usually follow.

Almost seven years ago in August 2017, I wrote an article titled “All-Time High.” I highlighted that the Dow Jones Industrial Average (composed of 30 large US stocks) crossed 22,000 points. As of June 28th, the index stood at 39,118 which is almost double from where it stood 7 years ago. The performance over years and not days and months is what really matters. As long as people go to work every day and companies strive to grow, we will see new all-time highs over and over again. Stay the course!

If you would like to discuss or learn more, schedule a call or meeting with me using the link below:

Tripp Yates, CPA/PFS, CFP®

901.413.8659 tripp@eaglestrong.com

Tripp’s passion for financial planning is evident to each and every client he meets with. His desire is to help his clients organize their finances, reduce taxes, and invest wisely. As a fee-only fiduciary advisor, Tripp strives to work in a humble and transparent way.

With extensive experience in financial planning and investment management, Tripp diligently uses his credentials of CPA and CFP® to benefit his clients. Over the last ten years, he has managed over $100 million in assets for individuals and families. In 2017, he founded Eaglestrong Financial, specializing in helping dentists and business owners. Outside of work, Tripp enjoys running, spending time with his family, and cheering on his favorite sports teams. He is a member of Harvest Church.

References

Investment returns obtained from Kwanti Portfolio Analytics. 01/01/2024 to 06/30/2024. S&P 500 TR = 15.29%. Dow Jones Industrial Average TR = 4.79%. Russell 2000 Index TR = 1.73%. MSCI EAFE Index TR = 5.34%. MSCI Emerging Markets Index TR = 7.49%. Barclays US Aggregate Bond Index = -0.71%.

Avantis Investors Monthly ETF Field Guide December 2023

https://www.eaglestrong.com/2017/08/08/all-time-high/

https://x.com/zerohedge/status/1808502130057134524

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

https://x.com/SethCL/status/1806293178363871377

https://my.dimensional.com/one-pagers/the-market-and-us-presidential-elections

https://x.com/ServoWealth/status/1807431935490187496

https://www.eaglestrong.com/2017/08/08/all-time-high/

https://finance.yahoo.com/quote/%5EDJI/history/

Disclaimer

Eaglestrong Financial, LLC is a Registered Investment Advisor offering advisory services in the states of TN and MS and in other jurisdictions where exempted. The information contained herein is not intended to be used as a guide to investing or tax advice. This material presented is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Past performance is no guarantee of future results.

#eaglestrong #eaglestrongfinancial

Share with others: